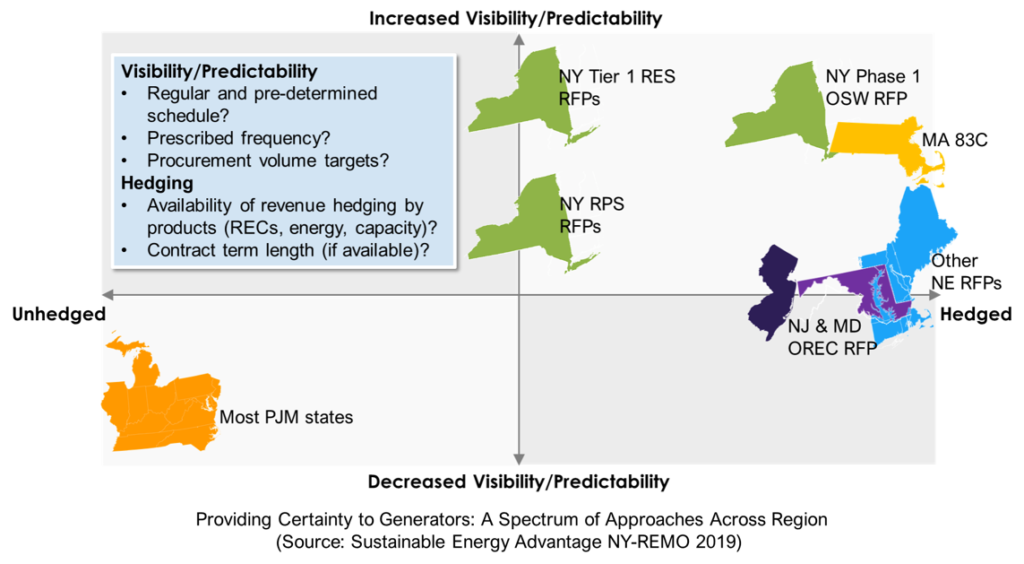

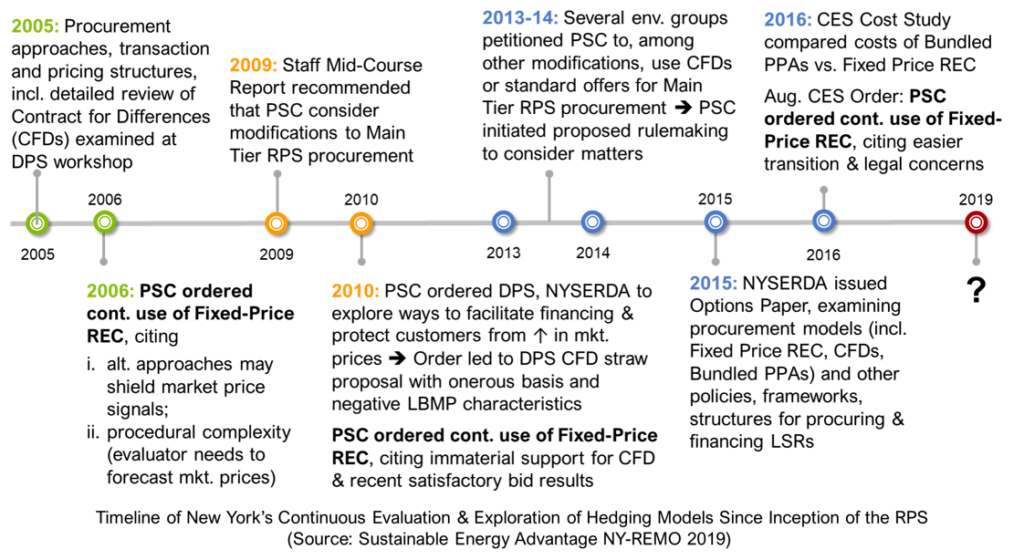

New York’s 50% by 2030 renewable goal is supported by NYSERDA’s massive large-scale renewable procurement program to help get needed facilities financed and built. Dating back to its first Main Tier RPS solicitation in 2005, NYSERDA has offered contracts for fixed-price RECs. While offering more hedge to generators than its PJM neighbors, New York’s approach has (in contrast to its neighbors in New England) placed commodity electricity market risk on generators, with such risk dampening the market’s attractiveness to investors and leading to higher financing costs.

On March 12, 2019, the Alliance for Clean Energy New York (ACE NY) and the American Wind Energy Association (AWEA) petitioned the New York Public Services to consider offering generators commodity revenue risk hedge through an Index REC hedging structure in future NYSERDA large-scale renewable procurements.

In light of increasing uncertainty of future wholesale electricity revenues driven by aggressive clean energy targets and NYISO’s proposed introduction of a carbon price in its wholesale market, transitioning to an Index REC approach – if New York ultimately chose to move in that direction – would move the state along the continuum toward providing substantially more commodity electricity market price hedge (and revenue certainty) to generators. This transition would no doubt minimize financing costs and likely be welcome by investors, although the degree of hedge and its attractiveness will depend on design details. It would also trigger a range of impacts that might differ from New York’s neighbors: in New England, the renewables purchase price vs. REC resales revenue volatility ends up impacting distribution rates, whereas (depending on details yet to be defined) the New York impact may be felt more directly in rates for generation service.

The NY Public Service Commission adopted an Index OREC (offshore wind renewable energy credit) approach for NYSERA’s first offshore wind procurement, departing form past fixed-price REC procurement to offer a better hedge to yield lower expected financing costs and cost premiums. By doing so it has also created an easier path toward adopting Index REC for New York’s large-scale renewable procurement by (for offshore wind) prioritizing these benefits over the counterarguments which prevailed in past consideration of similar approaches. However, it is not smooth sailing as there will be unique bid design issues and market adaptability challenges to be tackled with implementing Index REC in a head-to-head competition among bids of different technologies and more diverse locations.

As mentioned above, it is not the first time the discussion surrounding hedging approaches has come up. In at least four different junctures since the first Main Tier RPS solicitation, New York has considered alternative hedging structures for its procurement program has but stopped short each time.

Since New York’s last consideration of hedging structures in 2016, there have been shifts in stakeholder perceptions and new mitigation factors that have neutralized these challenges. Changing market circumstances also put pressure on a refreshed look at the conversation surrounding hedging approaches in New York. Will there finally be enough momentum to push New York toward a new hedging approach?