The Basics

On October 3, 2019, the New York State Energy Research and Development Authority (NYSERDA) released high-level information for the cohort of projects that submitted bids in response to its 2019 Renewable Energy Standard Request for Proposals (RESRFP19-1). Similar to its first two RFPs under the Renewable Energy Standard (RES) program, NYSERDA is offering 20-year contracts for the purchase of fixed-price RES Tier 1 renewable energy credits (RECs), and the RFP seeks deliveries of approximately 1.5 million per year. However, in each of its two previous RESRFPs, NYSERDA ultimately selected and contracted for REC deliveries well above its announced procurement targets, which NYSERDA could do again this year.

In response to RESRFP19-1, developers submitted bids from 54 eligible projects totaling 4,323 MW of capacity. All of the bids were for either in-state solar or wind resources, with six projects providing optional battery storage offerings. In addition to 5 greenfield wind projects, the wind projects bid into the RFP include 3 repowering projects owned by Terraform Power (we note that the current eligibility requirements treat repowering projects as “upgrades,” and only consider the incremental energy production to be Tier 1 eligible).

As with the prior RESRFP18-1, there were no hydro, biomass, biogas, or fossil-fuel powered fuel cell projects bid into RESRFP19-1. The absence of hydro projects may reflect high development costs/ uncompetitive economics, long development leads times, or diminishing incremental repowering opportunities. The absence of biomass, biogas, or fossil-fuel powered fuel cell projects could be driven by similar reasons, although their expected future loss of eligibility under the RES pursuant to the recently passed Climate Leadership and Community Protection Act (CLCPA) could also be at play, despite the RFP including a clause grandfathering projects that were Tier 1-eligible under the effective CES rules at the time that NYSERDA released the RFP.

fossil-fuel powered fuel cell projects could be driven by similar reasons, although their expected future loss of eligibility under the RES pursuant to the recently passed Climate Leadership and Community Protection Act (CLCPA) could also be at play, despite the RFP including a clause grandfathering projects that were Tier 1-eligible under the effective CES rules at the time that NYSERDA released the RFP.

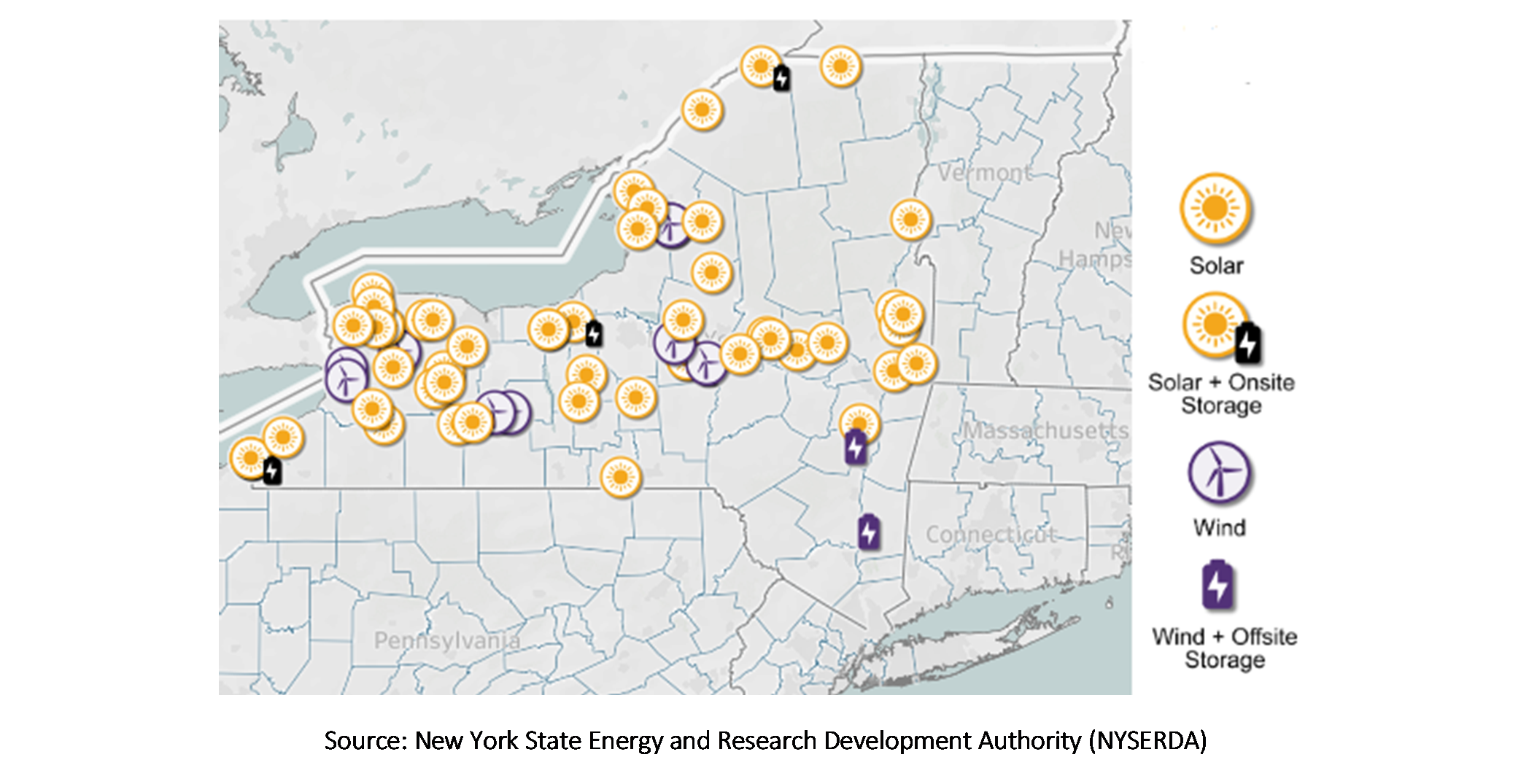

NYSERDA provided a map of all of the qualified projects (see below), as well as 1-page downloadable PDF files (for a randomly chosen example of the project 1-pagers that NYSERDA released, click here) that contain limited information on each project bid, including name, proposing counterparty, capacity, location, NYISO interconnection queue position, and a general description of the project as submitted by the proposer (we note that the level of detail for the description varied widely from project to project).

Comparison to RESRFP18-1 Bidding Pool

RESRFP19-1 represents NYSERDA’s third RES procurement and is now the second RFP for which NYSERDA published project-specific bidding information, with RESRFP18-1 being the first. While records of previous procurement responses are limited, we can still make some observations about market changes by comparing the 2018 and 2019 responses.

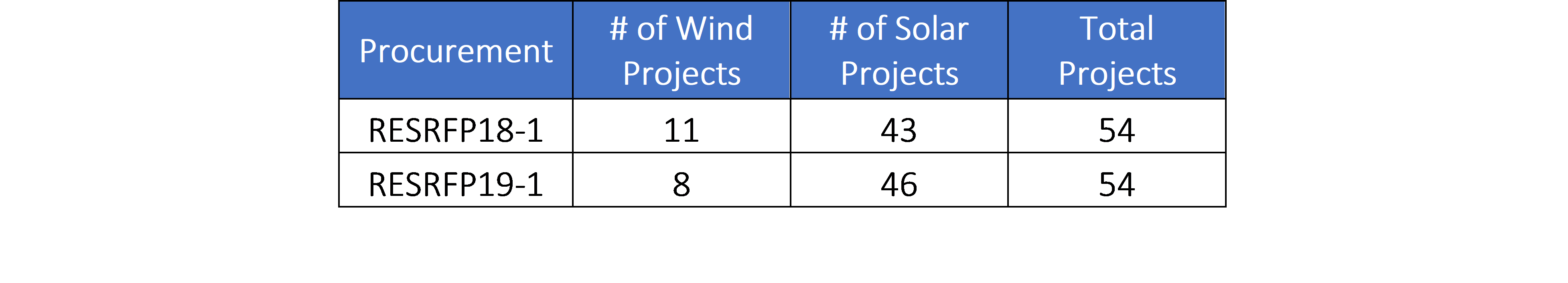

Interestingly, NYSERDA received bids for 54 wind and solar projects for both RESRFP18-1 and RESRFP19-1. Digging a bit deeper into the numbers, however, suggests some shifting market trends:

- Total Capacity: Developers bid about 3,200 MW of project capacity into RESRFP18-1, an average of 59 MW per project, whereas about 4,323 MW of project capacity was into RESRFP19-1, an average size of about 80 MW per project. Year-over-year, this represents a 35% increase in MW per project.

- Share of Wind and Solar: Purely in terms of number of projects, the proportion of wind to solar project bids fell slightly when comparing RESRFP19-1 to RESRFP18-1.

However, when comparing bid capacity, the shift from wind to solar from RESRFP18-1 to RESRFP19-1 is even starker. While there were 1,200 MW of wind and 2,000 MW of solar bid into RESRFP18-1, wind capacity bid into RESRFP19-1 totaled just over 500 MW, compared with about 3,800 MW of solar.

The differences in the capacity share of wind and solar between RESRFP18-1 and RESRFP19-1 are driven both by decreased scale for wind projects (2 of the 5 new build wind projects offered in RESRFP19-1 are 20 MW, while the largest wind projects from RESRFP18-1, Invenergy’s 291 MW Canisteo Wind Farm and 300 MW Bull Run Wind, did not participate in the 2019 RFP), and by increased scale for solar projects, including four separate 350 MW solar projects bid into RESRFP19-1. For comparison, the largest solar projects bid into RESRFP18-1 were NextEra’s 280 MW Excelsior Energy Center and Invenergy’s 180 MW Horseshoe Solar.

Assorted Impressions of the Project Bid Cohort

A few assorted observations from the SEA team on the RESRFP19-1 project bid cohort:

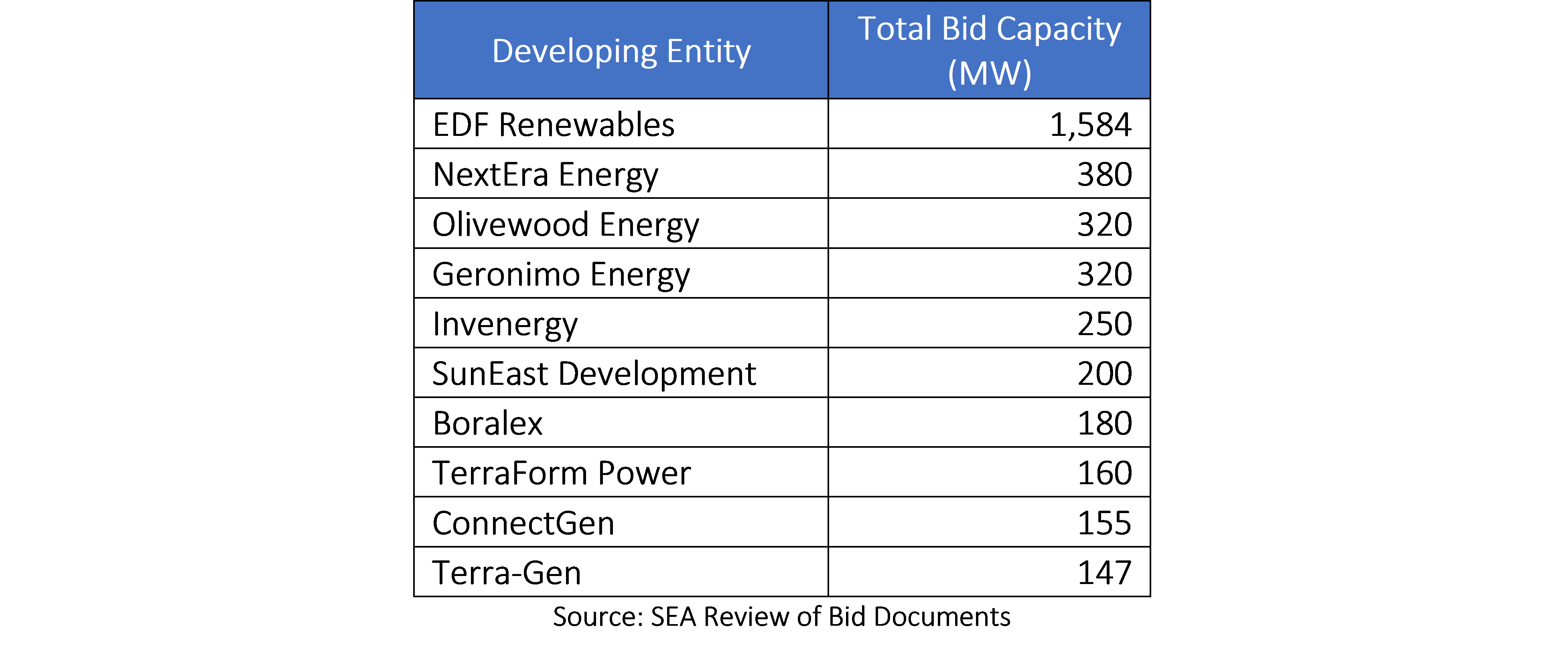

- Developers: In total, SEA identified 22 developers that submitted at least one project into RESRFP19-1. EDF Renewables was the largest bidder by MW, submitting proposals for 1,584 MW across six solar projects, followed by NextEra Energy with 380 MW across two solar projects. TerraForm Power was the largest bidder of wind projects, with 160 MW across three repowering projects. Several developers appear to have submitted RESRFP bids for the first time, including Boralex, ConnectGen, and Building Energy Holding. The top 10 developers by project capacity are provided below.

- Solar Scale: Similar to what’s been seen in recent procurements in adjacent markets (e.g., Rhode Island 400 MW RFP and Maine long-term contract RFP), larger solar projects appear to be increasing in popularity, likely because project developers can take advantage of additional scale economies. However, 20 MW solar projects represented a significant proportion of both the bidding cohort and winners for RESRFP17-1 and RESRFP18-1, and the 2019 bids show that developers are continuing to develop projects of this scale, with 29 solar projects sized at around 20 MW bid into RESRFP19-1. At 20 MW (or just under), developers can take advantage of small generator interconnection procedures and avoid the Article 10 permitting process, each offering less costly and sometimes faster paths than faced by larger projects. It will be interesting to see if these smaller projects can continue to compete with projects that have greater scale moving forward, although we note that price is only a part of the evaluation process. NYSERDA evaluates projects based 70% on their bid price, 10% on their incremental economic value, 10% on project viability, and 10% on operational flexibility and peak coincidence.

- Solar Technology Trends: Some solar developers also specified technologies and project configurations in their 1-page descriptions, and it appears that there is not yet a single dominant configuration for New York solar projects. For those that included such information, 6 projects totaling about 113 MW proposed to use a fixed-tilt setup, while 13 projects totaling about 790 MW proposed a single-axis tracker setup. In addition, Geronimo Energy indicated that it intends to use bifacial modules for its four projects, which total 320 MW. Based on SEA’s research on market interest in bifacial solar, we expect that several other developers may also be planning to use bifacial modules without identifying that in their public-facing fact sheets.

- Wind Development Trends: As previously discussed, there continues to be what appears to be a clear trend away from greenfield wind development in New York, which may reflect diminishing opportunities for successful siting of wind, as many of the best sites have already been developed, and local acceptance proves increasingly challenging. It may also reflect continued changes in the relative economics of wind versus solar; although SEA’s own supply curve modeling shows that both wind and solar can be competitive in the right circumstances, the relative probability of successful development for each technology may change how developers view each technology. We observe that several developers who actively develop both wind and solar have been increasingly focusing on solar in their New York development efforts.

Project Permitting Status

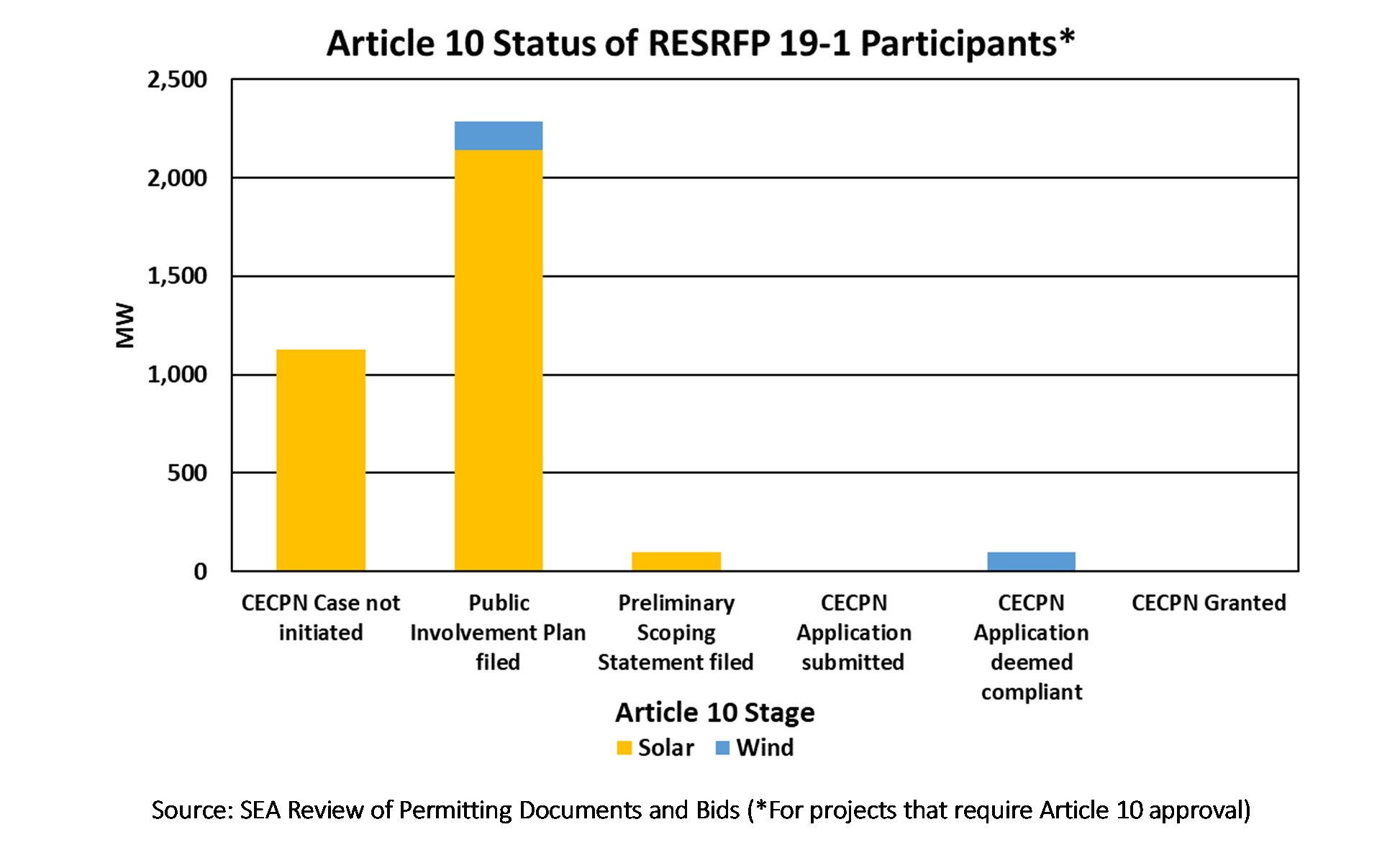

Among projects bid into RESRFP 19-1 that are subject to the Article 10 review process (25 MW or greater; smaller projects instead go through the State Environmental Quality Review Act, or SEQRA, process, along with affiliated local reviews), the permitting maturity varies widely. We observe that almost all projects that bid into RESRFP19-1 either have not started or are at the beginning of the review process (see figure below). The project that is furthest along in the Article 10 process is Deer River Wind, which initiated its Article 10 review in May 2016 and has already had the Board on Electric Generation Siting and the Environment deem its application co mpliant. On the other end of the spectrum, seven projects have yet to initiate the Article 10 process, while another ten have initiated the process but have only submitted their Public Involvement Program Plan, the first stage in the pre-application process. Will the evaluation process lead to (and will NYSERDA value) the selection of projects that have advanced further in the permitting process?

mpliant. On the other end of the spectrum, seven projects have yet to initiate the Article 10 process, while another ten have initiated the process but have only submitted their Public Involvement Program Plan, the first stage in the pre-application process. Will the evaluation process lead to (and will NYSERDA value) the selection of projects that have advanced further in the permitting process?

Finally, we note that twelve active Article 10 projects that have not yet secured public offtake contracts did not participate in the RFP, totaling 2,240 MW of capacity (listed by Article 10 initiation date, youngest first):

- Alder Creek Solar (200 MW, Avangrid)

- Big Tree Solar (175 MW, ConnectGen)

- Bunker Solar Energy Center (125 MW, EDF)

- Rich Road Solar Energy Center (240 MW, EDF)

- Trelina Solar Energy Center (80 MW, NextEra)

- Tracy Solar Energy Center (119 MW, EDF)

- Bull Run Solar (170 MW, Invenergy)

- Franklin Solar Project (150 MW, Geronimo)

- Mad River Wind Farm (350 MW, Avangrid)

- Bull Run Wind Energy Center (449 MW, Invenergy)

- Lighthouse Wind (200 MW, Apex)

Although developers may have withheld projects for any number of reasons (permitting and interconnection issues/uncertainty, interest or prior offer in other markets such as New England, interest in other potential future solicitations, etc.), decisions not to participate in RESRFP19-1 may have also been driven by a desire to see how certain market uncertainties play out, such as the NYISO Carbon Pricing proposal and the potential use of an Index REC for future NYSERDA solicitations, either of which would change the balance of a project’s energy and REC revenue streams significantly.

Wrap-Up

As indicated above, NYSERDA’s annual RFPs continue to draw a robust response, with several notable trends among responding bidders, including location, share of technology, project size/scale, and project maturity. Bid selections will be made in the coming months (NYSERDA announced bid selections for RESRFP18-1 in January 2019). Stay tuned for SEA’s NY-REMO analysis in the coming months for continued analysis of RESRFP19-1 and much more about the New York renewable market.