New York’s Clean Energy Standard (CES) is getting an update! CES 2.0, as the new program proposal has been dubbed, includes many interesting new details on how New York State plans to achieve the 70% by 2030 renewable electricity goal mandated by the Climate Leadership and Community Protection Act (CLCPA). Prior to releasing details on CES 2.0, NYSERDA contracted with Sustainable Energy Advantage, LLC (SEA) to conduct a thorough analysis of the CES program to date – in particular the Renewable Energy Standard (RES) portion of the CES – to serve as a factual foundation for the proposed CES 2.0 modifications.

RES Program Impact Evaluation + CES Triennial Review

The RES Program Impact Evaluation and the CES Triennial Review was filed with the Public Service Commission on June 1. Our report catalogs progress towards meeting policy objectives and targets, and highlights several interesting findings based on the data available (in most cases through the end of 2018). We found that NYSERDA’s RES procurements to date have succeeded in:

-

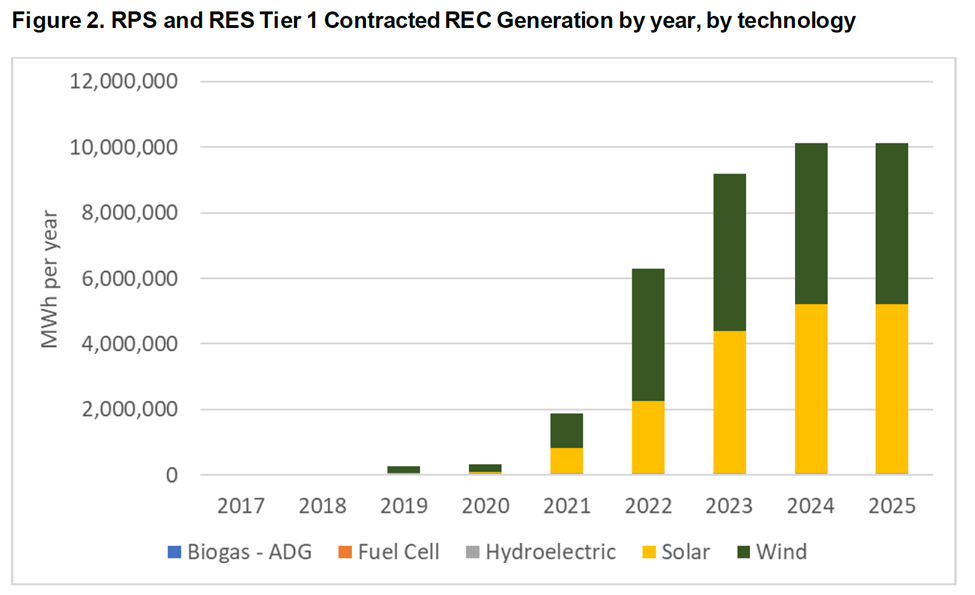

- Contracting with large-scale renewables in quantities over twice NYSERDA’s initial targets, with increasing proportions from utility-scale solar (see Figure 2).

Source: RES Program Impact Evaluation and the CES Triennial Review

-

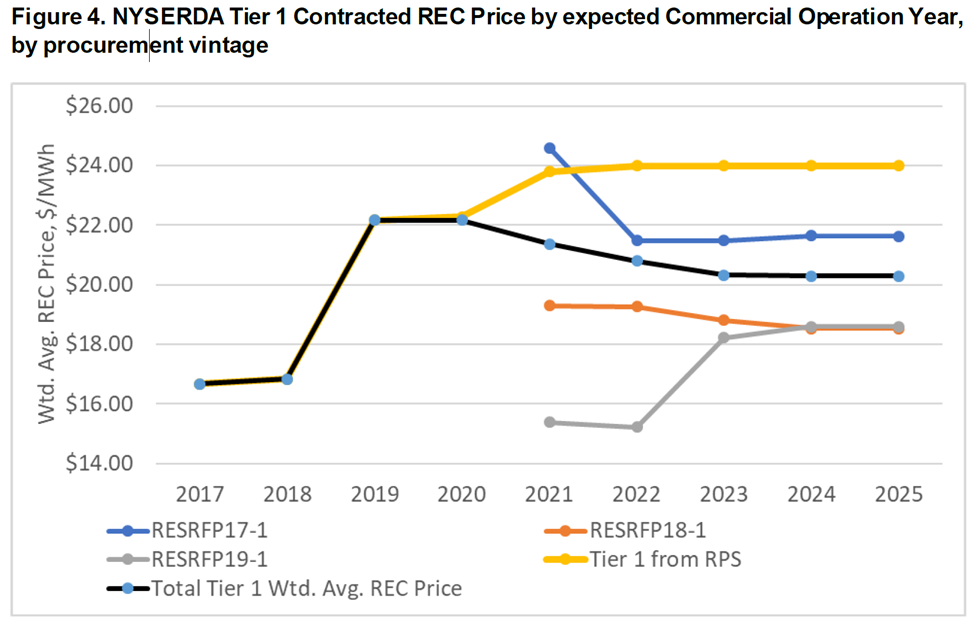

- Decreasing expected Tier 1 REC prices (see Figure 4).

Source: RES Program Impact Evaluation and the CES Triennial Review

-

- Stimulating a robust renewable energy project development pipeline.

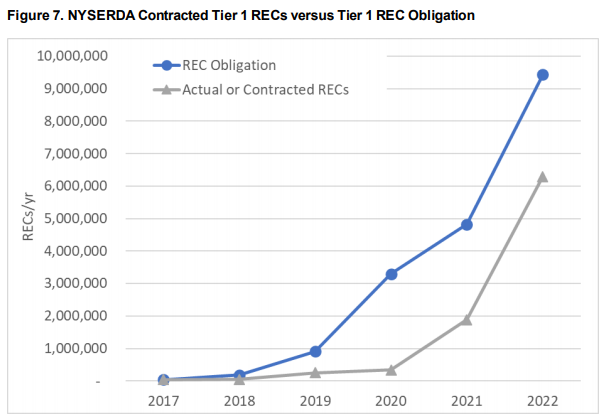

We also cataloged how contracted projects are, so far, taking significantly longer than expected to reach commercial operation due primarily to siting, permitting and interconnection considerations. We found that if all projects currently under contract to NYSERDA were to reach commercial operation at the dates currently expected by NYSERDA, RES Tier 1 RECs delivered to NYSERDA would lag Tier 1 load-serving entity (LSE) obligation targets by 1 to 2 years (see Figure 7).

Source: RES Program Impact Evaluation and the CES Triennial Review

The report also highlights the recent adoption of the Accelerated Renewables Growth and Community Protection Act, containing new streamlined permitting processes anticipated to mitigate the time required for large-scale renewables to reach permitting decisions, and other provisions intended to relieve transmission constraints.

The financing challenges and risks faced by contracted projects under the NYSERDA’s Fixed-Price REC regime are also noted in our report. With the Fixed REC price offered to NYSERDA, bidders are exposed to risks of declining prices for unhedged commodity revenues, which could impair a project’s ultimate financial viability. The report highlights the PSC’s recent adoption of an Index REC option for forthcoming NYSERDA RES procurements, designed to mitigate the project financing risk challenges inherent in the Fixed REC price structure.

CES 2.0 Whitepaper

The release of the much-anticipated NYSERDA and DPS CES 2.0 Whitepaper on June 18 shed light on the State’s simultaneous strategies and tactics to achieve the goals of the CLCPA. The White Paper has something of interest to every stakeholder:

-

- Brought further clarity to the roles of NYPA and LIPA in coordination with NYSERDA towards meeting the CLCPA goals;

- Clarified eligibility changes and their implications, including revisions to repowering rules;

- Laid out the quantity of renewables needed to meet 70% by 2030, and the share each program component is expected to contribute towards meeting the goal;

- Estimated the potential targets for future Tier 1 RES procurement;

- Identified modifications to Tier 1 procurements;

- Laid out plans for future offshore wind procurements;

- Described initiatives to benefit disadvantaged communities;

- Introduced a new ‘Tier 4’ for renewables supply that could be injected into New York City;

- Included a potential role for incremental large-scale hydroelectric supply to New York to count towards meeting CES targets;

- Posed questions on potential modifications to NYSERDA’s Tier 2 procurement proposal to support and retain in New York legacy renewables supply;

- … and more.

Finally, one impactful change proposed by NYSERDA and DPS in their CES 2.0 Whitepaper that flows directly from the analysis in the RES Program Impact Evaluation and the CES Triennial Review is to decrease LSE obligations for renewable energy supply for the years 2021-2022. Wait a minute? Decreasing obligations to achieve an increased target… how does that work?

LSE obligations are currently published on a three-year rolling trajectory (under current CES 1.0 requirements), and NYSERDA and DPS have proposed reducing the established 2021 obligation from 4.20% to 2.04% and the 2022 from 8.4% to 5.61%. NYSERDA and DPS have also proposed a 2023 LSE obligation of 8.20% (slightly lower than the previously established 2022 obligation). The near-term reductions should not come as a complete surprise, as this rebalancing concept is at the core of two components to the CES, NYSERDA’s Annual Divergence Test and the Triennial Review. This move relieves ratepayers from funding significant Alternative Compliance Payments due from their electricity suppliers resulting from the anticipated supply shortfall noted above. But it does leave a lot of ground to be made up in 2024-2030 to achieve a 70% obligation target, and the White Paper lays out the plan to get there.

The many elements of the CES 2.0 proposal will each have their own impacts on the renewable energy landscape, and will also interact in nuanced and complex ways to shape the market.

Next Steps…

During the expected 60-day comment period (yet to be officially announced), we can expect a flurry of activity from stakeholders sparking robust debate on the details of the program, and that many facets of the CES 2.0 proposal may change before final implementation.

During that period (and beyond), Sustainable Energy Advantage will continue to provide timely updates and premier analysis through our New York subscription services: Eyes & Ears and NY Renewable Energy Market Outlook (NY-REMO).

-

- With these fast-moving developments, what better time to sign up for an Eyes & Ears no-obligation trial?! Sign up now and receive our detailed June 23 Special Flash Update summarizing the CES 2.0 White Paper in its entirety. Please contact Kate Daniel to learn more…

-

- SEA will be providing a Special Brief on CES 2.0 ($250, or half price for Eyes & Ears subscribers – including those on the no-obligation trial – and free to NY-REMO subscribers), expected to be released in early July. The Special Brief will discuss in greater depth not just what the White Paper proposes, but our assessment of what it all means to stakeholders, including:

-

-

- Developers of and investors in – land-based wind, utility-scale solar, and other large-scale renewables; energy storage; supply sources that can deliver to NYC; offshore wind; and transmission.

-

-

-

- Owners of legacy supply sources – including hydroelectric and wind; candidates for repowering; and biogas, biomass, and fuel cells using non-renewable fuels.

-

-

-

- Load-serving entities.

-

-

-

- Community Choice Aggregators and voluntary ‘green power’ market participants, disadvantages communities… and more.

-

-

- Our next NY-REMO Market Fundamentals Briefing will be presented on July 29, 2020, and will include an in-depth analysis of the CES 2.0 and implications for stakeholders. Please contact Aaron Geschiere for more information on our NY-REMO services.

- Our next NY-REMO Market Fundamentals Briefing will be presented on July 29, 2020, and will include an in-depth analysis of the CES 2.0 and implications for stakeholders. Please contact Aaron Geschiere for more information on our NY-REMO services.